Lab User Design Strategy in Today’s Shifting Market

A few short years ago, lab/office spaces were in high demand. Companies seeking space were facing a market shortage and were desperate for any available space to expand. Now, there are more space options on the market and potential tenants can be picky. According to CBRE’s Greater Boston Life Science Q3 2025 market report, “Vacancy reached a new all-time high, hitting 27.7% largely caused by 788,000 sq. ft. of new speculative developments that delivered in Q3, none of which were preleased.” This adds complexity for both owners of space and seekers of space. For owners, how can you ensure space is seen by tenants that are the right fit, and that you stand out against the competition? For companies seeking space, how can you tailor your search to find the ideal space for your company today, while planning for future growth, and without being overwhelmed by options? A granular understanding of the unique spatial and programmatic needs across the spectrum of the Life Science market can turn these complexities into your strategic advantage—if you can navigate them.

At CBT, our in-house Life Science and Innovation Group has a wealth of experience programming and designing these spaces, which allows us to understand the unique needs of science and innovation companies. We understand how these needs change over a company’s growth cycle and funding stage and how they are further tailored to accommodate users in specific sub-market sectors based upon research type.

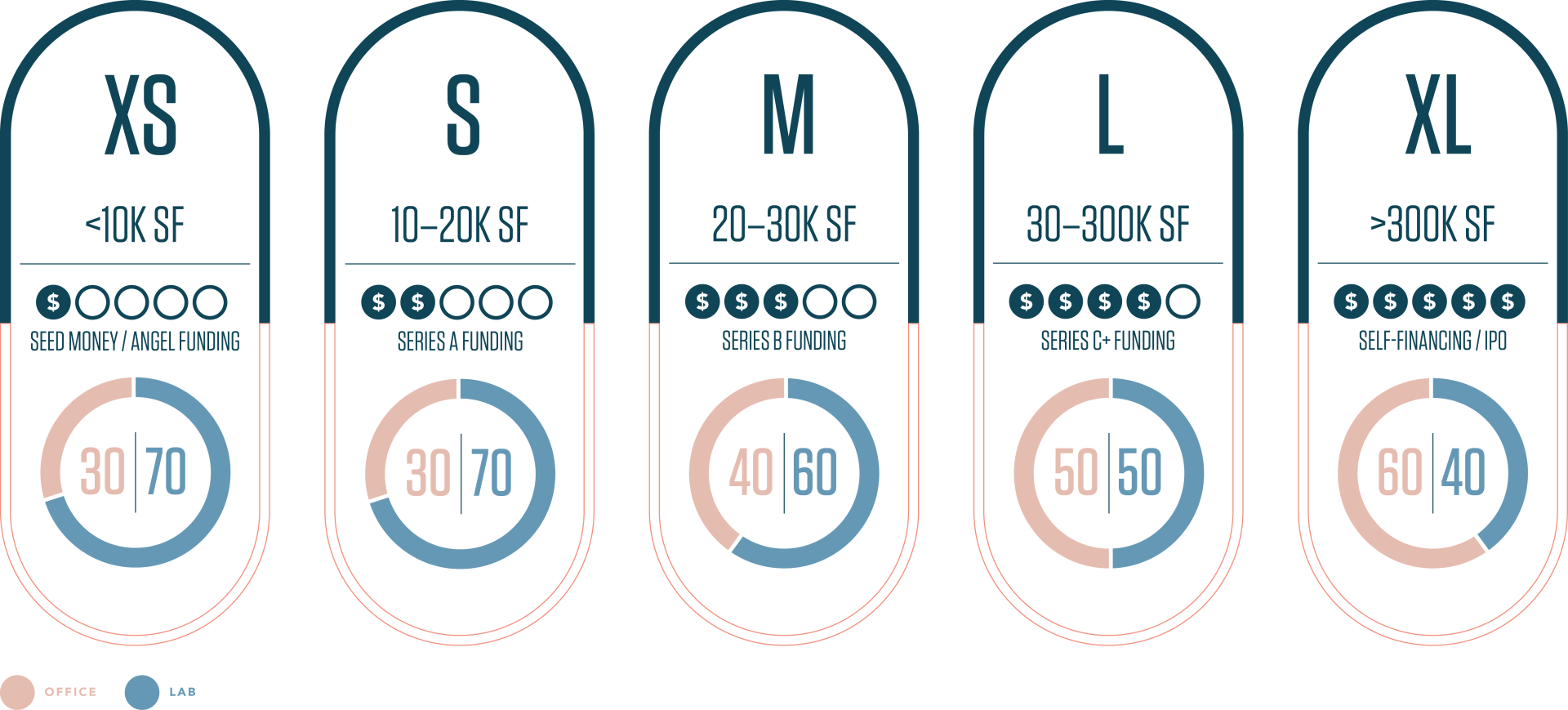

Additionally, as the life science sector continues to evolve and increasingly intersect with other innovation-driven industries like ‘Tough Tech/Advanced Tech’ and process manufacturing labs, it presents exciting repositioning opportunities for both tenants and building owners. Emerging biotech companies that are capitalizing on advancements in AI, machine learning and computational biology for drug discovery and development are now making their presence felt in the leasing markets. These AI-centered biotech companies are often able to embrace more efficient and streamlined lab footprints. Many of these companies using AI-based research platforms are shifting typical assumptions of lab/office programming splits and are often able to do more with less space. Computational labs are increasingly fusing with wet labs, creating an iterative and hybrid workflow that allows for increased speed and success rates as well as validation. These new hybrid labs are increasingly relying on robotics and automated processes that allow the actual lab footprint to be more efficiently utilized. While AI-driven platforms may require less wet-lab space they are also making new demands on infrastructure as we are seeing dramatic increases in data and power needs. As AI continues to transform the way new medicines are discovered, the real estate lab markets will have to adjust accordingly to provide the tools needed for these changing needs.

These emerging markets—spanning advanced manufacturing, materials science, med tech, energy storage, clean energy, robotics, and quantum computing—are now competing for space alongside traditional life science companies. Like biotech, these ventures are science-driven, and infrastructure-intensive. However, their spatial needs often differ, requiring hybrid layouts that combine lab space with pilot-scale manufacturing, engineering shops, overhead cranes, and high-bay environments.

In response, many building owners are adapting their facilities to accommodate both life sciences and advanced tech—also known as “tough tech”—to appeal to a broader and more resilient tenant base. This growing trend underscores the importance of working with design teams that understand not only lab planning but also the infrastructure demands of engineering and process manufacturing.

Lab Design Guidelines

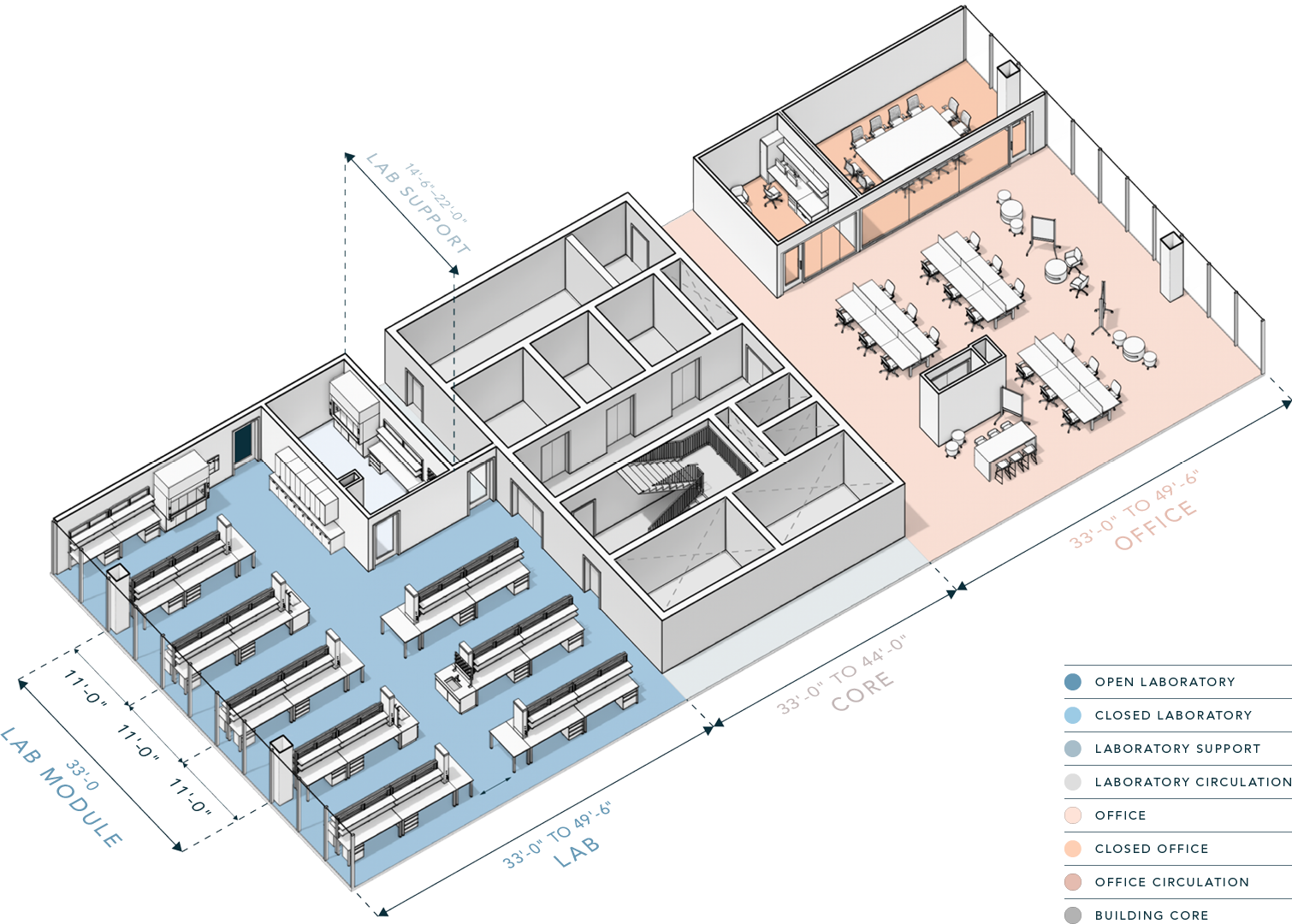

Drawing on our deep bench of Life Science and Advanced Tech experience, CBT has created a Lab Design Guide specifically to help tenants navigate this evolving market. We have taken a complex topic and made a straightforward tool. Our Lab Guide addresses:

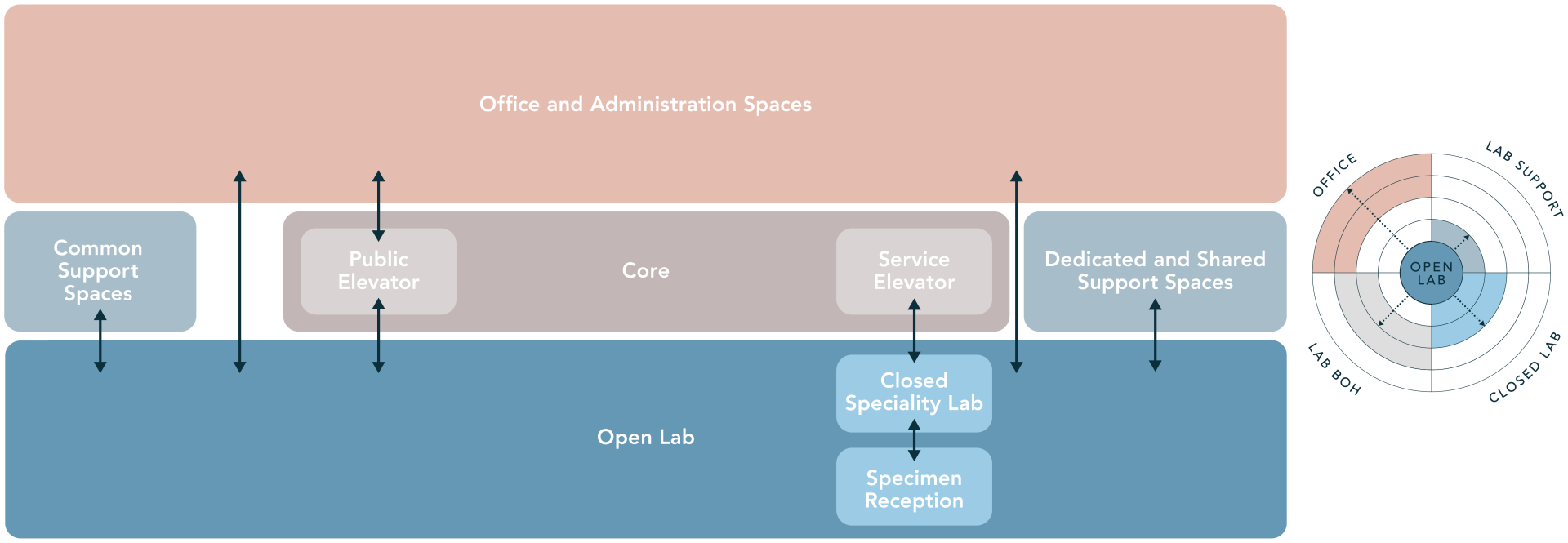

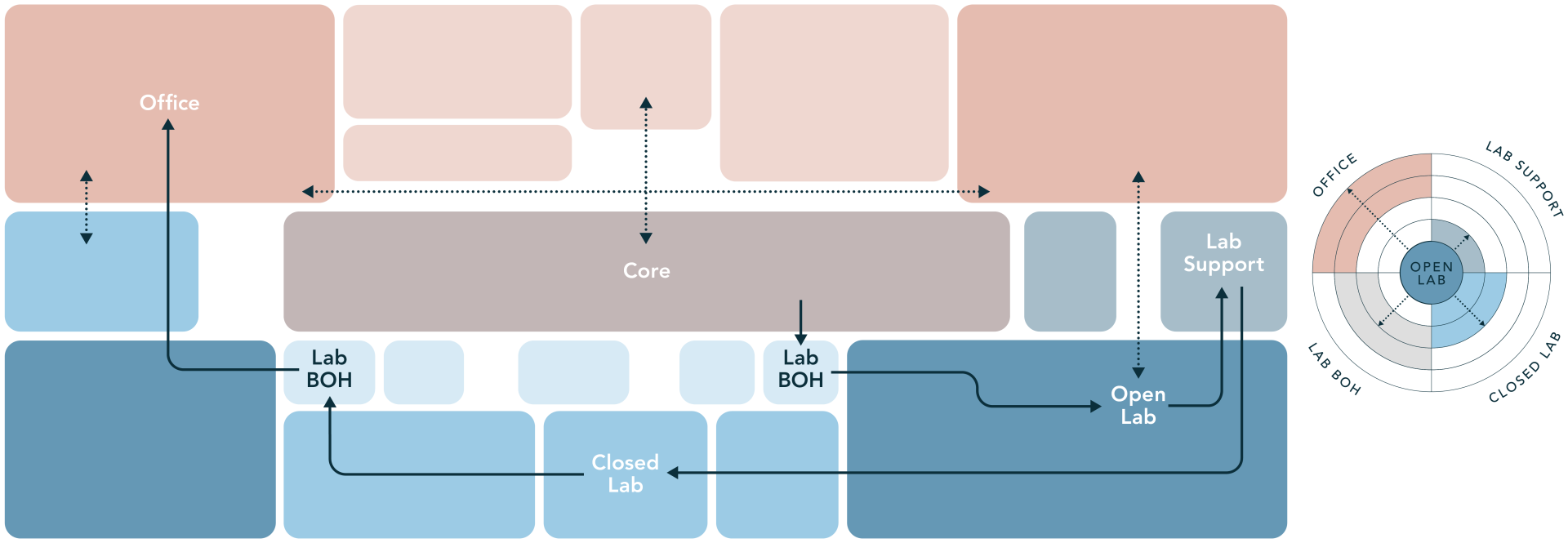

- Lab planning fundamentals

- Commercial Lab tenant types and their market applications

- Floor area breakdowns and key adjacencies for key tenant types

- Life Science company growth and funding stages and their spatial implications

- Example and best-practice Tenant Fit-Out Case studies

These are presented in a clear and concise visual guide to take a dense set of information and convey it simply and compellingly.

Confirm lab, office, and core elements, spatial ratios, and key adjacencies and circulation requirements against baseline BOD.

Develop options that spatialize program requirements, areas, adjacencies and circulation onto proposed floorplate

Detailed test fits

The Greater Boston life science ecosystem remains one of the most dynamic in the world. While vacancy rates may be rising, demand for fit-out opportunities remains strong. Informed design is the differentiator that helps both building owners and tenants succeed and maintain a competitive edge by being adaptable to ever-changing conditions around them. The lessons emerging in Boston resonate nationally, and life science leaders everywhere can benefit from clarity around their growth stage, typology, and programmatic needs.

The key is to insist on clarity when looking for new space—including a clear understanding of your growth trajectory, defining your lab typology, and demanding feasibility studies before committing. The right space can be a strategic asset, not just a roof over your research.

Interested in learning more? Check out our article on Lab Design News that explains how CBT’s life science design experts are designing flexible, tech-ready labs to turn market uncertainty into a competitive advantage.